Singapore

Janus boosts Singapore operations

Janus boosts Singapore operations

US fund manager Janus named Augustus Cheh as president of non-U.S. business arm Janus Capital International. It also stated that it will base a fund manager in Singapore as part of a plan to grow its global operations. Cheh, formerly CEO of AllianceBernstein Hong Kong, will take up his new position at Janus effective March 29. He will be based in Hong Kong. Janus, which manages $161 billion globally, also announced plans to grow its Singapore operations by hiring Hiroshi Yoh as portfolio manager of Asian equity strategies and Singapore CEO. "Yoh will help to build up an on-the-ground investment team�based in�Singapore," a Janus spokesman in Hong Kong said. "This will enhance our existing research capabilities and allow us to increase stock coverage in this very important region." Yoh, previously Tokio Marine Asset Management's Singapore CEO and chief investment officer for Asia excluding Japan, will start on April 1.

Aviva Investors gets Singapore licence

Aviva Investors has received a licence to provide fund management services to retail and institutional investors in Singapore.

Yu’s Threadneedle appointment signifies Asian growth push

Threadneedle appointed Raymundo Yu to the newly created position of Asia Pacific Chairman. Mr Yu’s appointment will expand relationships and build on the established presence of Ameriprise’s asset management businesses in Asia, leveraging the considerable investment capabilities of Threadneedle and its sister company Columbia.

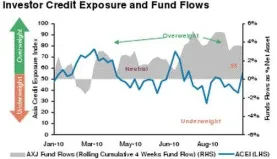

Asian funds no longer underweight - Morgan Stanley

The Asia Credit Exposure Index (ACEI) rose from 38 to 55 last month, according to a report on Asian credit from the financial services firm.

JPMorgan mulls to beef up Asian private banking

Lender plans to step up non-US business from Asia to 50% from current 20%.

DBS targets 20-30% assets growth in major Asia markets

Lender expects to expand S$35bln private banking operations by adding China, Indonesia, and India market.

Singapore Exchange's September securities trading up 20%

Record volume of 4,530 contracts for SGX Nikkei Dividend Futures contract was achieved in September.

First Advisory Group expands to Asia

Liechtenstein-based financial services company First Advisory Group, Vaduz is opening offices in Singapore and Hong Kong.

SGX sees sustained derivatives trading and OTC clearing growth

Reported 10% daily average value traded growth and 19% year-on-year surge in overall derivatives trading volume.

CapitaMalls Asia issues S$350 million worth of notes

Net proceeds of the notes will be used to finance investments of CapitaMalls Asia and CapitaMalls Asia Treasury.

SGX to draw more traders with new market initiatives

Newly-appointed Senior Vice President and Head of Fixed Income, Ms Tng Kwee Lian, will take charge of the proposed trading improvements.

SGX and LME to launch monthly metal futures by 2011

Singapore’s market will be the first in Asia to make metal futures available to investors.

Wealthy Singaporeans cautious about investments

Yet more than half of them still managed to grow net worth in the last six months.

Westcomb Capital gets go-ahead as Catalist sponsor

The addition of Westcomb Capital increases Catalist's Sponsor pool to 9 Continuing Sponsors and 10 Full Sponsors.

SGX and London Metal Exchange talk on Asian expansion

Although the scope of projects is not yet certain, both exchanges said they recognise the potential of a tie-up.

Temasek overcomes deficit as it increases value by S$56 billion

Temasek said it will continue to build its institution for the long term and deepen commitment to the wide community in Singapore and the rest of the world.