Streamline your bank with Appian: How low-code automation can fuel digital transformation

Learn how banks can leverage low-code automation to improve efficiency, transform digitally, and deliver better customer experiences.

Financial institutions of today face the urgent need to improve outdated processes as they seek to meet modern consumer demands for seamless experiences and efficient operations.

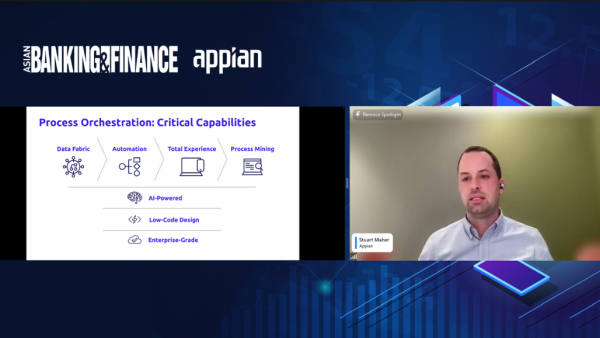

The recent webinar, “Thriving in the Digital Age: The Power of Process Orchestration in Banking,” hosted on 28 May 2024 by Asian Banking & Finance in collaboration with Appian, provided an in-depth look into this need for transformation in the banking sector.

Industry experts Stuart Maher, Area Vice President, Customer Success, Appian; Ronaldo Jose Puno, Chief Technology and Transformation Officer, UnionDigital Bank; and John Raphael Aquino, Low Code Development Lead, UnionDigital Bank, offered insights on leveraging low-code automation to enhance operational efficiency, drive digital transformation, and deliver exceptional customer experiences.

Setting the stage, Maher discussed the pressing need for banks to modernise their legacy systems and processes to stay competitive in highly regulated environments. He emphasised the importance of leveraging automation alongside integrated and connected platforms like Appian to enhance operational efficiency, reduce manual efforts, and improve front-end experiences.

Maher highlighted Appian’s capabilities including Data Fabric which is an integrated data layer that connects data across your enterprise. He also illustrated Appian’s application in various banking processes, from onboarding to case management, showcasing its scalability and ability to handle complex problems.

Building on Maher’s insights on data, Puno highlighted the need to remember “garbage in, garbage out,” as he explored artificial intelligence (AI) as a hot topic across industries today.

“If you don't have something like a data fabric to standardise the data that you're working with to derive [AI-driven] decisions, it’s garbage. So just be mindful of that. Therefore, there needs to be a sequence to it. Get your data right first, before you get into AI,” Puno said.

For his part, Puno mainly focussed on UnionDigital Bank's journey as a fully digital bank in the Philippines, one of the few profitable digital banks early in its operations. He highlighted challenges faced by UnionDigital with regards to banking in a country where a significant portion of the country lacks formal identification and primarily uses cash.

He detailed the bank's digital transformation journey starting in 2016, underscoring that efficiency, compliance, and scalability were the central points they tackled early in their journey. He noted that when UnionDigital initially laid out their roadmap to transformation, they sought to use over 100 platforms to address 50 different transformation areas. Acknowledging that this strategy would only bring further complexity, UnionDigital switched to a simpler approach. “We [needed] to be able to find the platform that can do 90% of all of those 50 transformation areas,” Puno recounted.

This is where Appian was adopted into the digital bank’s transformation journey. The Appian platform streamlined and automated various processes for UnionDigital, resulting in significant efficiency gains in areas such as loan application processing and anti-money laundering reporting.

UnionDigital's approach enabled it to scale rapidly without physical branches, achieving customer growth. Advising banks to keep it simple, he stressed, “You don't need 200 platforms to run a bank.”

Further exploring UnionDigital’s journey, Aquino delved into the key learnings they took from the six- to seven-year digital transformation. He emphasised the importance of adopting an automation-first mindset, “When designing applications and processes, automation should not be an afterthought anymore... We need to avoid technical debts that can just shoot us in the foot later on.”

Echoing Puno’s advice to keep it simple, he discussed optimising through a cost-effective licensing model through low-code platforms like Appian, which achieves “more with less.” However, he also noted that organisations must find models that ultimately fit them.

Lastly, he stressed the importance of inclusive empowerment, ensuring both external customers and internal employees have user-friendly and efficient tools, which boosts confidence and reduces employee attrition. “Empower everyone and take care of your people. Use technology and process orchestration, not just for saving up on costs but [for making] it easier for everyone.”

Meanwhile, both Maher and Aquino drew attention to building a strong foundation when starting any transformation journey.

“Make sure you think through how you want to structure where you're going, as well as what the vision is. Have that focus on establishing a platform in a way that's going to allow you to keep that evergreen and constant evolution going within your business,” Maher said. “It's not a one-time implementation. You're establishing a platform for change.”

Missed the event? Watch the event recap on-demand to hear industry experts and streamline your bank with low-code automation.

Advertise

Advertise