More digital banks make a profit, but still face higher credit risks

As they grow, they shouldn’t rely on their parent companies to back them up.

Although more digital banks have crossed profitability, they still continue to grapple with heightened credit risks due to their target market and credit costs.

At least 16 of over 45 digital banks in APAC have achieved breakeven as of October 2024, according to a study by Fitch Ratings.

Of these, six are in Japan. Such banks tend to be more risk averse and have a longer record of profitability, the ratings agency noted in its report “APAC Digital Banks' Risk and Opportunities.”

More are optimising their balance sheets in a bid to reach and sustain profitability.

“Some with more competitive funding capabilities are diversifying into safer residential mortgage or corporate lending, which may reduce overall risk in their loan portfolios,” Fitch said.

Digital banks currently remain more exposed to credit risk than incumbent banks due to their target market of underserved retail customers and small and medium enterprises (SMEs).

Interest rates are expected to fall in most markets in 2025, which in turn should improve borrowers’ ability to repay their loans as well as reduce bank funding costs.

But this doesn’t solve the risk of higher default rates, and the lower rates may actually heighten such risk as it may fan risk appetite in the sector, Fitch warned.

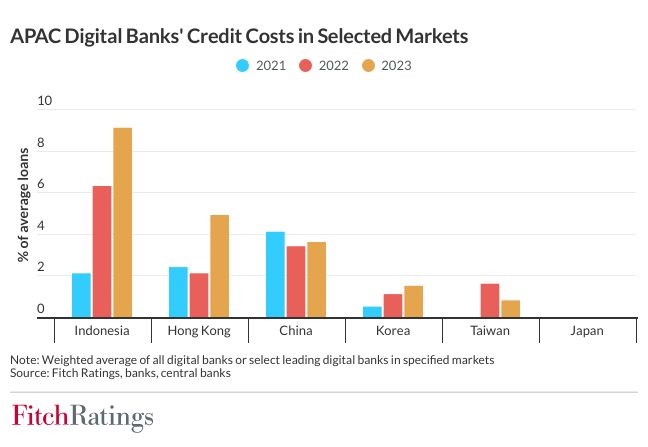

“Lenders typically charge higher loan interest rates to compensate for the higher default rates, though recent spikes in credit costs at some digital lenders underscore the challenges in managing these risks,” Fitch said.

“This has been highlighted by a recent spike in credit costs at some digital lenders against the backdrop of relatively high interest rates, for example in Indonesia, the Philippines and Hong Kong,” it added.

Virtual banks’ reliance on the digital savvy customers and more price-sensitive deposits also makes them more vulnerable to deposit outflows and liquidity stress, according to Fitch.

On the other hand, this has also helped attract depositors swiftly.

For now, liquidity risks can be mitigated by parental support, Fitch said.

Several of these digital banks are backed by large conglomerates and even established banks— for example, Singapore’s GXS Bank is backed by Grab, the Philippines’ GoTyme Bank is backed by retail and mall giant Robinsons, and Hong Kong’s Mox is backed by British multinational bank Standard Chartered.

The ratings agency warned, however, that the digital banks' rapidly growing balance sheets may constrain such support in the future.

![Cross Domain [Manu + SBR + ABF + ABR + FMCG + HBR + ]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-01/earth-3537401_1920_4.jpg.webp?itok=WaRpTJwE)

![Cross Domain [SBR + ABR]](https://cmg-qa.s3.ap-southeast-1.amazonaws.com/s3fs-public/styles/exclusive_featured_article/public/2025-01/pexels-jahoo-867092-2_1.jpg.webp?itok=o7MUL1oO)

Advertise

Advertise