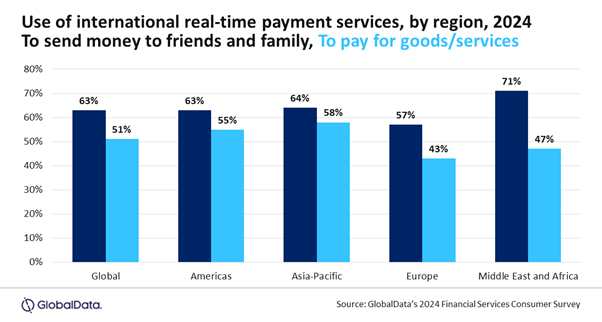

3 in 5 use real-time cross-border payments to send money to family and friends

This is higher than those who use it to pay for goods and services.

Real-time cross-border payments have grown in popularity for consumers sending money to family, far outpacing the number of people using it to pay for goods and services.

Over 3 in 5 (63%) of global consumers now use international real-time payments services to send money to family and friends, according to a survey by data and analytics company GlobalData.

This is higher than the 1 in 2 (51%) who use them only to pay for goods and services.

The survey involved 61,000 respondents across 41 countries, conducted in Q2 2024.

Real-time cross border payment’s availability 24/7, reduced transaction costs, and ease of liquidity for business management helped propel its growing use, said Stephen Walker, lead banking and payments analyst, GlobalData.

“They also represent the next major step for cross-border payment services, as the volume of cross-border payments also ramps up over the coming years,” Walker said.

This comes as the Financial Stability Board found a shortfall in G20 targets on real-time payments. Less than half (42%) of funds is available to consumers in an hour, versus the target of 75%, as per an October 2023.

Of funds available in one business day, the share of such retail services is 76%, versus a target of 100%.

Advertise

Advertise