Chart of the Week: Growth of local e-commerce drives rise of e-payments in Australia

Buy now, pay later solutions are popular amongst Millennials.

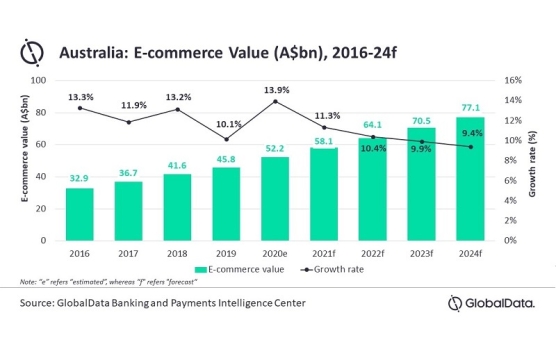

Australia’s e-commerce market is expected to continue growing through 2024, albeit at a slower pace than in 2020, to reach $54.2b (A$77.1b) in total sales in three years’ time, reports data and analytics firm GlobalData. And as Australian consumers continue to embrace online shopping, the use of electronic payments will also increase as consumers move away from cash.

Payment solutions such as PayPal, POLi, Apple Pay and Google Pay are benefitting from this trend.

“COVID-19 has changed consumer buying behavior as they are increasingly switching from offline to online channels. With social distancing rules and closure of many brick and mortar stores, shoppers had to embrace online channels for day-to-day shopping,” notes Shivani Gupta, banking and payments analyst at GlobalData.

GlobalData’s study posits that e-commerce payments in Australia are estimated to have grown by 13.9% in 2020 and should have reached $36.7b (A$52.2bn) by the end of last year, as wary consumers stayed home and used online channels to avoid physical contact.

Data from the Australian Bureau of Statistics revealed that online sales in Australia registered a 55% rise in December 2020 compared to same period in the previous year.

Australia Post’s Online Shopping Report published in January 2021 also shared that over 5.6 million Australian households shopped online in December 2020, a 21.3% growth compared to 2019 average.

One mode of payment that has seen growth in popularity amongst Australians are “Buy now, pay later” solutions. Millennials, in particular, use this as a budgeting tool to spread payments.

Almost 5.8 million Australians have a buy now pay later account with brands including Afterpay, Zip, Openpay, Humm and Klarna. According to GlobalData, Afterpay accounts for 5.6% of the total e-commerce payments.

Advertise

Advertise