RuPay ends Mastercard and Visa duopoly in India

The number of debit cards issued hit 605.3 million.

Debit cards from the government-backed RuPay more than doubled to 605.3 million in 2019 from 263 million in 2015 in India, surpassing that of American payment giants Mastercard and Visa combined in 2017, according to GlobalData.

In terms of transaction numbers and value, Visa and Mastercard remained dominant, but the share of RuPay cards in the overall debit card market grew at a compound annual growth rate (CAGR) of 59.3% from 6.1% in 2015 to 24% in 2019

According to GlobalData analyst Ravi Sharma, the upsurge was primarily driven by the government’s financial inclusion program, Pradhan Mantri Jan-Dhan Yojana (PMJDY), which offered low-cost bank accounts along with RuPay debit cards.

In March, the One Nation One Card on RuPay’s platform was launched to allow holders to pay for bus travel, toll taxes, parking charges and retail shopping, further driving RuPay card usage.

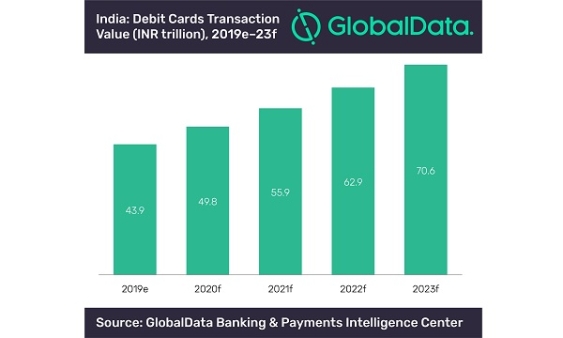

The total transaction value of debit cards in circulation in India is expected to grow to $997.81b (INR70.6t) in 2023 from $620.39b (INR43.9t) in 2019.

Advertise

Advertise