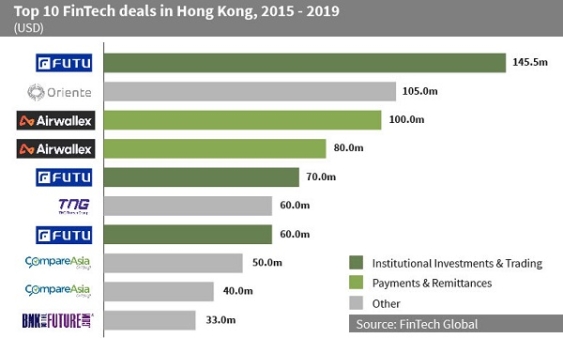

Check out Hong Kong's top fintech deals from 2015-2019

Online brokerage firm Futu Holdings raised $145.5m, the largest deal since 2015.

Hong Kong’s ten biggest fintech deals from 2015-2019 collectively raised $743.5m, with three of those transactions coming from institutional investment & trading company and two from a payments & remittances company, reports Fintech Global.

Chinese online brokerage company Futu Holdings raised $145.5m in a private equity round led by Tencent Holdings in June 2017, the largest deal in Hong Kong since 2015. The company used the funding to do further R&D, develop its products, and strengthen their cooperation with NASDAQ and the Hong Kong Stock Exchange.

Futu Holdings has experienced internal growth for the last few years, increasing its revenue from $22.9m in 2018 to $74.6m in 2019 and growing its workforce to 561 employees.

Meanwhile, cross-border payments firm Airwallex, raised $100m in a series C round led by DST Global in March 2019. The company’s valuation reached over $1b due to this funding round and, joined the unicorn club, all within three years of launching.

Airwallex has indicated that it plans to continue its expansion globally, which means expanding in the US and UK, noted Fintech Global.

Other companies that made the list include insurtech firm CompareAsiaGroup, blockchain & cryptocurrency company BNKToTheFurture, Marketplace Lending firm Oriente, and wealthtech company TNG FinTech Group.

Advertise

Advertise