Hong Kong records $2.92b in fintech investments for 2019

WeLab $1.21b funding round was the largest fintech deal for the year.

Hong Kong nearly doubled its fintech investment to $2.92b in 2019, according to a study by Accenture. The number of deals jumped 32% to 25 from 19.

WeLab clinched the largest fintech deal in Hong Kong for the year, the mobile and online lending platform raising $1.21b (US$156m) in December. The company is also amongst those launching virtual banks in Hong Kong this year, noted Accenture.

Also read: Fintech investments crashed 65.6% to US$188m in 2018

Other large transactions in the city included the $779.43m (US$100m) credit line secured by asset management firm FinEX in June and the $233.83m (US$30m) insurtech OneDegree closed in May, as well as CompareAsiaGroup’s US$20 million raised in in August and the $116.91m (US$15m) investment into trade finance platform Qupital in March.

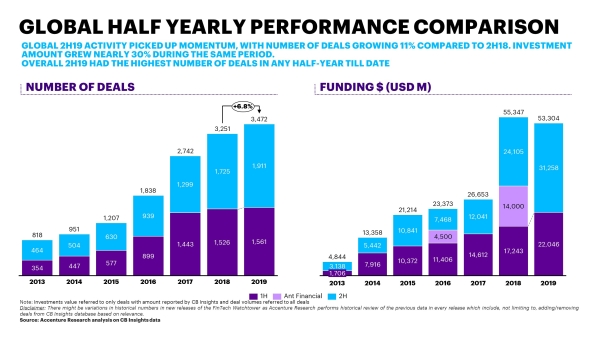

In contrast, the total value of fintech deals globally dipped 3.7%, to $415.46b (US$53.3b) from $431.05b (US$55.3b) in 2018, when totals were boosted by a record $109.3b (US$14b) from Ant Financial and three other multi-billion-dollar transactions from Chinese companies.

“Despite strong demand for fintech globally, it’s likely that, as startups become more mature, investments will flow to fast-growing economies, where there’s still a huge, unaddressed consumer and corporate market thirsty for innovations,” said Julian Skan, a senior managing director in Accenture’s Financial Services practice.

“For now, there’s still a lot of growth, particularly for challenger banks that are expanding in their home markets and overseas, as well as for payments providers that are embedding solutions seamlessly into our day-to-day activities.”

“With Singapore, Australia and other markets all issuing new digital banking licenses and established players like Revolut and Monzo venturing into new markets, challenger banks could remain a focus for investors in 2020,” Skan added.

Advertise

Advertise