Majority in Indonesia, Philippines and Vietnam to transact digitally by 2021

Faster funds transfer can add up to 0.5% in GDP growth for SEA.

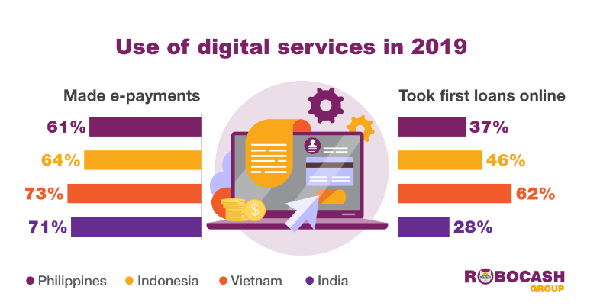

About 80% of the population in the Philippines, Vietnam and Indonesia will have made at least one digital payment transaction by 2021, with the share of active users making five or more e-payments per week exceeding 50%, according to a Robocash study.

At the same time, the volume of unsecured consumer loans issued online will reach 50% in the Philippines, 60% in Indonesia, and 70% in Vietnam.

Habits formed around the pandemic and physical distancing will accelerate the growth of digital lending and payments, Robocash said, as the speeding up of funds transfer can add up to 0.5% in GDP growth for Southeast Asian countries in 2022 to 2025.

Last year, the majority of company customers in these countries made e-payment transactions but the frequency was low, as only 13% in the Philippines, 16% in Indonesia and 23% and Vietnam made five or more transactions per week. On the other hand, more people in these countries (62% in Vietnam, 46% in Indonesia, and 37% in the Philippines) took their first remote loans last year.

Advertise

Advertise