Singapore's fintech investments hit $1.21b in 2019

It is now the fifth biggest fintech market in APAC.

Fintech investments in Singapore more than doubled to $1.21b (US$861m) in 2019 from only $511.46m (US$365m) in the previous year, according to a study by Accenture. The number of deals in the country also jumped 52% to 108 from only 71 in 2018.

This puts the country as the fifth biggest fintech market by funds in Asia Pacific, behind India, China, Australia and South Korea.

About 39% of the total funds raised last year went into payments startups, whilst insurtechs raked in 25% of the investments. Fintechs offering lending services also accounted for 13% of the total.

Also read: Singapore fintechs nab 51% of funding in ASEAN as of Q3

Seven of the top 10 deals ever in Singapore’s history took place in 2019. These including the $140.13m (US$100m) cloud company Deskera closed in May and the $126.11m (US$90m) funding each received by credit risk analytics and lending startup FinAccel and insurtech Singapore Life. Another notable deal is financial products marketplace GoBear’s $112.1m (US$80m) funding round.

Financial hub rival Hong Kong also nearly doubled its fintech investments in 2019 to $524.07m (US$374m), whilst the number of deals jumped 32% to 25 from 19.

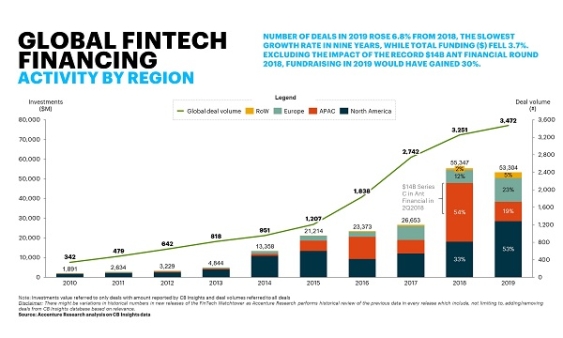

In contrast, the total value of fintech deals globally dipped 3.7%, to $74.69b (US$53.3b) from $77.49b (US$55.3b) in 2018, when totals were boosted by a record $19.61b (US$14b) from Ant Financial and three other multi-billion-dollar transactions from Chinese companies.

Also read: Singapore crowned as APAC's fintech leader

The value of deals in the US jumped 54%, to $36.5b (US26.1b), with the number of transactions rising 6.9%, to 1,232, signaling that investors remain confident about the future growth and demand for innovative digital solutions for banks, insurers and payments providers, noted Accenture.

In the UK, fintech investments rose 63% to $8.83b (US$6.3b) — almost the same as the total for 2018 and 2017 combined.

For the report, Accenture analysed data from venture-finance data and analytics firm CB Insights.

Advertise

Advertise