South Asians, SEA preferred repeat online loans in 2019

69% of Vietnamese had a single loan, but only 31% had repeat loans.

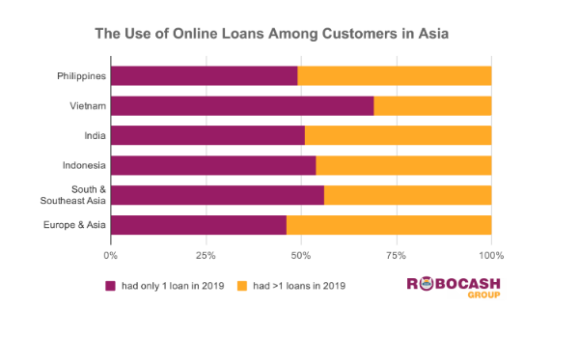

Fintech loans have become widespread in South Asia and Southeast Asia, where 44% of customers got repeated advances on online platforms in 2019, according to a Robocash study.

Vietnam stood out with a 69% share in online fintech loan applications across the region but had the lowest number of repeat customers at 31%, as the service is still relatively foreign to the country. The high internet penetration (70%) provides hope for fintechs in the country, the study said.

With fintech support from the local government, the Philippines posted the highest number of repeated customers at 51%. Meanwhile, almost half or 49% of the population had one active loan.

The country has become third in the world by mobile e-commerce (66%), and kept global leadership in terms of time spent online, Robocash noted.

More than half (54%) of Indonesians had one active loan in 2019, with the remaining 47% obtaining more than one, boosted by a 17% increase in mobile internet users that year.

The share of repeat customers in India amounted to 49%, the lowest amongst the four countries; 51% had an active loan. Taking second place in the world by fintech adoption stated by EY, the country sees a surging use of digital services by local people. Moreover, India had the highest increase in the number of Internet users in the world in 2019 (+23%).

Advertise

Advertise