New Zealand retail lending to hit $265.6b in 2023

Total retail loan balance outstanding is set to reach the same amount.

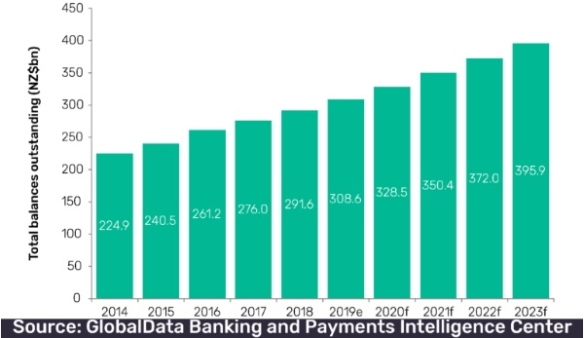

New Zealand’s retail lending market will reach $265.6b (NZ$395.9b) in 2023, with total retail loan balance outstanding set to hit $265.6b (NZ$395.9b) from $195.6b (NZ$291.6b) in 2018, according to a GlobalData report.

Majority of the country’s loan balance outstanding is from residential mortgage, personal loans, and credit card balances. Total consumer debt is estimated at $207b (NZ$321.6b) in 2019.

“Mortgage loans remain the largest and the fastest-growing segment supported by rising house prices, lower mortgage interest rates, and the government’s affordable housebuilding scheme, including the easing of loan-to-value,” said GlobalData senior banking and payments analyst Shivani Gupta.

Rising alternative non-bank lenders drove the increase in personal loans. Whilst the New Zealand lending space is dominated by the big banks ANZ, ASB, and Westpac, non-bank lenders, digital banks and digital lenders offer lower interest rates and faster loan approvals

Advertise

Advertise