Will Malaysian banks' loan growth dramatically increase after the 25bps overnight policy rate cut?

It is unlikely to pick up this time, says an analyst.

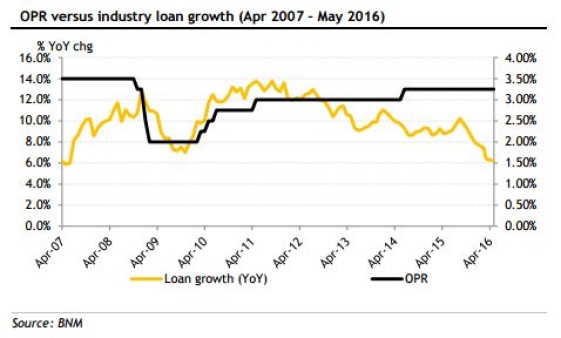

According to Maybank Kim Eng, when the Overnight Policy Rate (OPR) was cut post-GFC, there was a lagged effect but loan growth eventually picked up pace from sub-10% to an average of 11-13%. The question then is, would a 25-50bp cut result in a similar effect this time round as well?

The analyst is of the view that the stimulus effect from interest rate cuts this time around is likely to be more muted, and that loan growth is unlikely to pick up meaningfully from current levels because:

• The quantum of rate cuts this time around is not expected to be as aggressive as the 150bps cut back in 2009/2010.

• Household debt levels today are higher than they were before, at 89.1% end-2015 versus just 60.4% end-2008.

• Not only have banks tightened their credit assessment processes but anecdotal evidence would suggest that the quality of borrowers has also waned, resulting in a steady decline in industry loan approval rates.

• Loan/deposit ratios (LDR) are more elevated today at about 87.6% end-May 2016 versus just 77.9% back in Apr 2009. Coupled with sluggish growth in deposits, banks will likely remain selective in their lending activity.

Advertise

Advertise