Australia

Major Australian banks may take long to recover from headwinds

Hefty loan impairment charges may remain elevated.

Major Australian banks may take long to recover from headwinds

Hefty loan impairment charges may remain elevated.

Major Australian banks to absorb higher credit losses: report

Credit losses are likely to rise six times from historic lows in 2019.

Economic slump will drag Australian banks' loan performance: analysis

Wider effect will depend on stimulus measures and severity of disruption.

Australian banks feel the pinch despite stimulus package

Not enough cushion for impairment charges and bad debts.

Australian banks could withstand losses but longer disruption a risk

Credit losses will nearly double this year, with business loans leading the surge.

Citi Australia inks client transfer agreement with Royal Bank of Canada

RBC’s staff from Australia and Kuala Lumpur will be transferred to Citi.

Australian central bank pumps $3.64b into the banking system

The amount was larger than the intended $1.5b (A$2.5b).

MUFG prices world's first ESG-linked issuance for Sydney Airport

It is also the world’s first US Private Placement issuance.

MUFG Bank names Colin Richmond-Wells as Oceania transaction banking head

He was former HSBC London global head of client management for global liquidity.

Digital bank Xinja swipes more than $50m in deposits from Australia's big four banks

It hit $100m in deposits three weeks after its digital savings account launched.

Bushfires to have modest effect on Australian banks' credit losses: analysis

But losses from business lending could increase.

Australian borrowers hit by bushfires face risk of inadequate insurance coverage

Disruptions on local employment could drive arrears up.

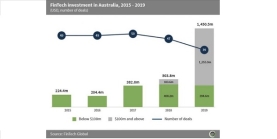

Australian fintech firms raise over $2.7b from 2015-2019

Deals over $100m comprised 41.9% of capital raised.

Australian banks asset quality still strong despite surging mortgage arrears

Capital ratios of major banks rose ahead of higher capital requirements by 1 January.

Westpac chairman, CEO to step down amidst money laundering probe

The bank is the third of Australia’s major banks to lose executives after scandals for the past year.

Australia's Westpac hit with up to $328t fine for money laundering

The bank is accused of enabling payments from child sex offenders.

Australian banks' earnings to remain under pressure in FY2020

No thanks to growing customer remediation costs.

Advertise

Advertise