Philippines

Philippine digital bank Tonik hits 1 million customers

It furthers the bank toward its goal of financial inclusion in the country.

Philippine digital bank Tonik hits 1 million customers

It furthers the bank toward its goal of financial inclusion in the country.

Less Filipinos fall short of meeting credit card payments

The delinquency rate has been falling since the COVID-19 pandemic started.

BPI Wealth tasked by PH state insurance to manage $45m investment fund

The investment fund amount is P2.5b.

Filipino Q1 credit card spending jumps nearly half from previous year

This was the highest recorded amount since the start of the COVID-19 pandemic in 2020.

Unsecured lending pushes Philippine banks’ retail lending growth

Salary-backed general consumption loans jumped 68.8%.

PH banks missing out on revenue from growing middle class market

Over 7 in 10 loans made by banks are extended to corporates– leaving 15 million SMEs and self-employed workers with little access to traditional finance.

BPI’s Q1 net profit increases by 52%, boosts efforts toward financial inclusion

The January to March performance was driven by the bank’s average asset base expansion, margin growth, and lower provisions.

Smiles Mobile Remittance adds bills payment for Filipinos in SG

This enables Filipinos based in Singapore to pay their bills via mobile phone.

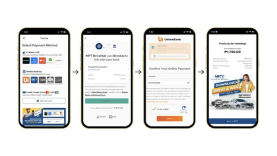

Brankas-MPT mobility partnership grants motorists quick toll reload via bank accounts

This collaboration targets to attract new app users that will benefit from lower service fees.

BPI launches refreshed mobile app

New clients can open an account within five minutes with just one valid ID.

Filipinos spent over 4 million hours using e-wallets in 2022: study

The country’s growing population will push the active user base higher.

BDO Unibank partners with Hyakujushi Bank

BDO will provide banking support services to HBL customers in the Philippines.

Philippine’s NextPay reaches P3.2b transactions volume in 2022

The company is also looking forward to a Series A funding round in the second half of 2023.

Philippine President supports the merger of two state-run lenders

The merger of the two banks would make it the largest Philippine bank in terms of assets.

UNO Digital Bank offers account opening services to GCash users

GCash users can open a savings or time deposit account with no minimum balance needed.

Security Bank face higher funding costs, lower margins in 2023

Loan growth is expected to fall by 9% year-on-year.

Philippines central bank OKs use of international sim for GCash services

The beta launch will be available for 1,000 users in Japan, Australia, and Italy.

Advertise

Advertise