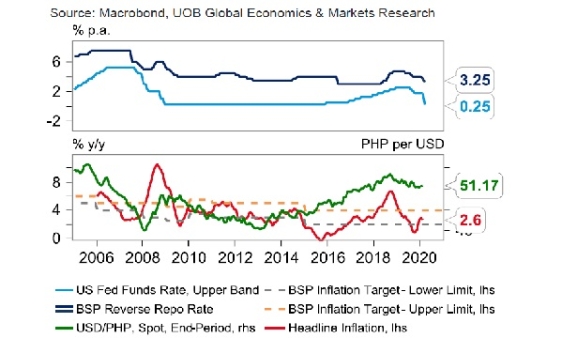

Chart of the Week: Philippines may cut policy rate further by 50bps in Q2

A further 200bps cut may happen in 2020 if the pandemic extends beyond June.

The Bangko Sentral ng Pilipinas (BSP) is expected to further slash its policy rate by another 50bps in Q2 2020, as the country braces for the full economic impact of the island-wide lockdown amidst the COVID-19 pandemic.

This will bring the reserve requirement ratio (RRP) to a new low of 2.75% by end-2020, according to UOB Global Economics & Market Research economists Julia Goh and Loke Siew Ting.

The regulator may cut another 200bps in RRR should the pandemic extend beyond June and the global economy enters into recession, added Goh and Loke.

BSP has revised down its 2020 growth forecasts to 5-5.5% from 6.5-7.5% previously, and signaled that any further deterioration from this could trigger more rate cuts.

The Monetary Board has also authorised BSP Governor Benjamin Diokno to reduce the RRR of BSP-supervised financial institutions of up to a maximum of 400bps for 2020. The timing, extent, and coverage is yet to be determined.

Other monetary supplementary measures are also expected to be announced over the coming weeks as an urgent initiative to address the adverse impact of COVID-19 on the economy and financial markets, in addition to fiscal stimulus measures, the UOB economists further noted.

Advertise

Advertise