Philippines’ Remolona warns of oil prices, interest rates as financial stability risks

The financial stability council also warned of geopolitical risks.

The Philippines’ top central banker warned that energy-related products and a high interest rate environment pose risks to the country’s financial system.

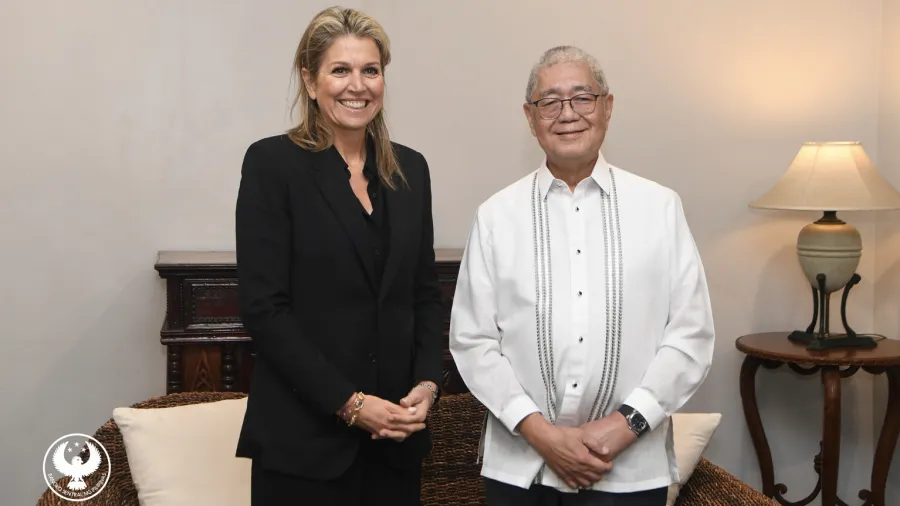

“[The] volatility in the price and supply of energy-related products can affect economic activity, while a high-for-long global interest rate situation will weigh on debt servicing in general,” said Bangko Sentral ng Pilipinas (BSP) governor Eli M. Remolona, Jr. during the latest meeting of the Financial Stability Coordiantion Council (FSCC).

Remolona, who is also the FSCC chairman, said that the council finds comfort in “broad indications of stability and their effects on the economy. “

In their latest executive committee meeting, the FSCC noted that whilst global indicators of market volatility have “remained low”, there is volatility in global oil prices.

US inflation has also reportedly come down but remains stubbornly high by the Fed’s own characterization. This suggests a high-for-long policy rate environment, which will likely affect the global economy.

The FSCC also warned against geo-political risks, calling such risks “protracted.”

However, it said that the Philippines’ economic growth remains strong, saying that it is “amongst the highest in the world.”

Recently, the BSP signalled its desire to develop the Philippine capital markets, saying that it will make the financial system more resilient.

Advertise

Advertise