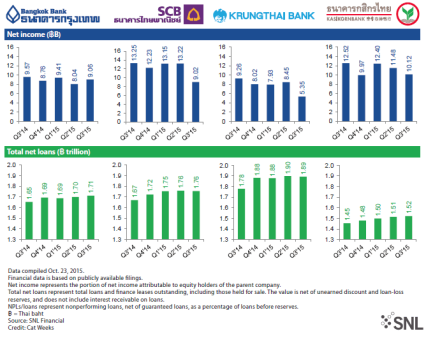

Debt threat: Top 4 Thai banks' 3Q15 combined net income slumps 25% due to bad debts

Krung Thai Bank and Siam Commercial Bank were the biggest losers.

According to SNL Financial, the Thai banks' deteriorating asset quality amidst an economic downturn was worsened by bad debts incurred by a major corporate, thereby dragging the combined 3Q15 net income of the top four banks in the country.

"Combined net income for the quarter ended Sept. 30 at Krung Thai Bank PCL, Siam Commercial Bank PCL, Bangkok Bank PCL and KASIKORNBANK PCL dropped 24.8% to 33.54 billion Thai baht from 44.60 billion baht a year earlier. Their asset write-downs more than doubled to 38.83 billion baht from 14.18 billion baht, as net interest income slipped to 76.01 billion baht from 76.73 billion baht. Net fee income increased 7.2% to 27.78 billion baht from 25.92 billion baht," notes SNL Financial.

During the quarter, Krung Thai Bank and Siam Commercial Bank, set aside additional provisions for loans to Thailand's largest steelmaker, Sahaviriya Steel Industries PCL, and its U.K. subsidiary. As a consequence, they reported the biggest declines in earnings for the three-month period among the top four.

"Krung Thai Bank posted a 42.2% year-over-year drop in third-quarter net profit, the steepest fall, with consolidated nonperforming loans jumping 59.22% as of Sept. 30 from Dec. 31, 2014. At Siam Commercial Bank, third-quarter net profit declined 32%, as NPLs ballooned 47.5% and impairment losses on debt widened almost fivefold," adds SNL Financial.

Advertise

Advertise