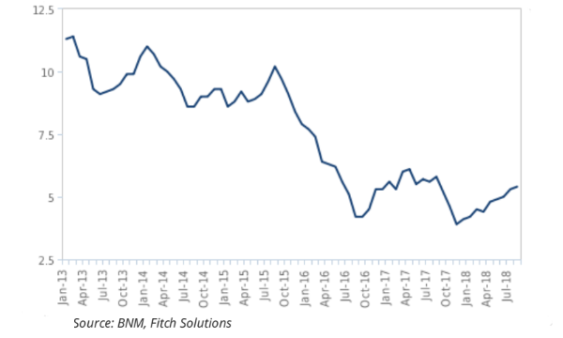

Chart of the Week: Malaysian bank loan growth may further soar in Q4

Loan growth in August went up to 5.4%, the highest it reached in 2018.

This chart from Fitch Solutions shows that Malaysian banks saw their loan growth increasing at 5.4% in August, reaching its highest for the whole of 2018. The average growth rate in August YTD hit 4.8%.

The lion’s share belongs to household loans in which 57.4% of the total loans came from. The sector’s loan growth inched up 6.1% during the month which is its fastest pace for 2018.

Fitch Solutions added that the zero-rating of the Goods and Services Tax (GST) positively affected credit card and auto loans as consumption boosted during the period.

“That said, we do not expect this uptrend to survive the reinstatement of the Sales and Services Tax (SST) with effect from 1 September,” the firm commented.

For credit cards, loan growth accelerated 4.9% YoY in August which is its fastest since March 2015 when consumers likely went to rush and purchase before the onset of the GST.

“Similarly, the August surge coincided with the last month of the consumption tax holiday and we believe consumers likely front-loaded their purchases in order to take full advantage of cheaper prices,” the firm explained. “This suggests a slowdown similar to that in the months after March 2015, when growth decelerated to an average of 1.0% in the remaining three quarters of 2015.”

Fitch Solutions said that loan growth will be slightly bearish amidst the weakening private consumption outlook.

Advertise

Advertise