Chart of the Week: Malaysian banks to benefit from lower funding costs

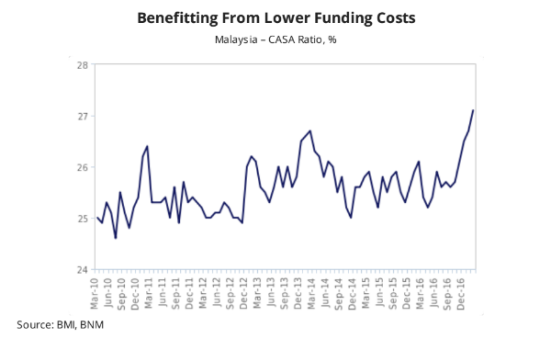

Thanks to the system's CASA ratio rising to a multi-year high of 27.1% in February.

According to BMI Research, the outlook for Malaysian banks is expected to recover over the course of 2017, in tandem with the improvement in the economic growth outlook, following challenging conditions over the past two years due to domestic and external headwinds such as political uncertainty and the collapse in commodity prices.

Here's more from BMI Research:

We are forecasting Malaysia's real GDP growth to come in at 4.7% in 2017 (from 4.2% in 2016) due to an improvement in terms of trade due to higher commodity prices and the government's ongoing infrastructure development projects.

This will therefore help to drive overall loan growth to 6.5% in 2017, from 5.3% in 2016, and keep the NPL ratio low (near the current rate of around 1.6%) over the coming months.

We also expect Malaysian banks to continue to benefit from lower funding costs, with the system's current and savings account (CASA) ratio rising to a multi-year high of 27.1% in February, according to data from Bank Negara Malaysia (BNM).

Lastly, the Malaysian banking system is relatively well-capitalised, with Tier 1 capital ratio standing at 14.0% in February, which will enable it to weather any unexpected economic shocks.

Advertise

Advertise