Chart of the Week: Thai banks raise capital shields against bad loans

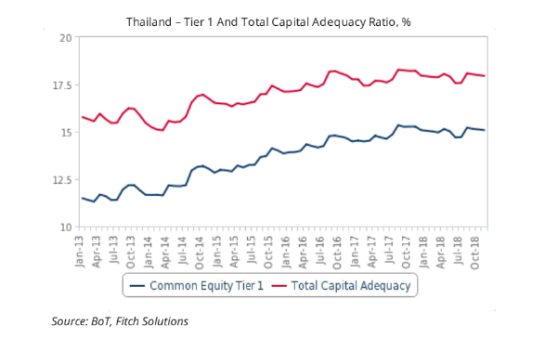

Total capital adequacy ratios hit 18% in November 2018.

The strong capital position of banks in Thailand play a critical role in insulating the sector from heightened risks posed by lending to the SME and consumer segments, according to Fitch Solutions.

Also read: Thai bank loans up 4.7% in Q1 as SME lending strengthens

As of November 2018, the common equity Tier 1 and total capital adequacy ratios for commercial banks came in at 15.1% and 18.0%. The headline figure is higher than the central bank's minimum requirement of 7.5% and 11.5% for domestic systemically important banks for 2019.

"Thai banks are well-capitalised by international standards, and in our view, the capital buffers are solid," Fitch Solutions said in a report.

Also read: Have the credit costs of Thai banks peaked?

Banks in Thailand are still taking on higher risks given their significant exposure to the SME segment which account for a third (33.6%) of overall loans.

The non-performing loan (NPL) ratio for SMEs hit 4.7% in Q3 2018 from 4.6% the previous year, highlighting their struggles to repay debt compared to corporates whose NPL ratio improved to 1.5% from 1.7% over the same period.

Advertise

Advertise