Most Philippine banks well-positioned to comply with new liquidity requirements: Moody's

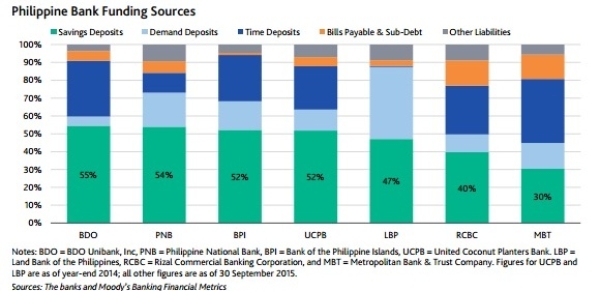

Philippine banks are 85% deposit-funded on average, and rely little on wholesale funds.

Bangko Sentral Pilipinas (BSP), the central bank, recently announced the imposition of a liquidity coverage ratio (LCR) that would ensure that Philippine banks have ample high-quality liquid assets (HQLA) to withstand a 30-day liquidity stress scenario.

Here's more from Moody's Investors Service:

The minimum LCR requirement will initially be set at 90%, effective January 2018, and subsequently increased to 100% from January 2019 onwards. The banks will start reporting their LCR data to BSP starting July 2016.

The proposed LCR rules are credit positive for the Philippine banks because they will strengthen their liquid asset buffers and reduce their liquidity risks. The LCR rules will increase safeguards in the bank’s asset liability management, particularly prudent in light the strong 16% average credit growth between 2011 and 2015.

The LCR requirements will ensure that banks maintain sufficient liquidity buffers and focus their funding on stable sources such as customer deposits, as opposed to market-sensitive wholesale funding.

We believe that most of the rated Philippine banks are well positioned to comply with the minimum LCR requirements because they all have strong core customer deposits and ample buffers of qualifying liquid assets.

We expect banks such as BDO Unibank, Inc., Philippine National Bank and Bank of the Philippine Islands to have an advantage in meeting the new requirements because they benefit from having a particularly large share of retail savings deposits, which have lower outflow assumptions in the 30-day stress scenario than corporate deposits.

In addition, the banks hold high quality liquid assets – mostly cash and Philippine government securities – that amount to over 38% of their total liabilities on average. These features provide sizable buffers against the assumed cash outflows in these banks’ LCR calculation.

Banks in the Philippines are already required to maintain a reserve requirement of 20% of their deposit liabilities. We expect some or all of these reserves will be eligible to be counted towards HQLA under the LCR norms.

Advertise

Advertise