Why Asian banks are scrambling to zero in on trade finance

Will this focus be a long-running trend?

Trade finance is a major focus for many banks in Asia at the moment, among both global banks and domestic Asian lenders.

According to East & Partners, with Asian economic growth powering along and the economies of the region more open than they have ever been to world trade flows, a common pattern is emerging among non-Asian banks wanting to gain a foothold in the region.

Here's more from East & Partners:

Banks from the US, Europe and Australia are all following their national corporates into Asia, increasingly leading with trade services and then looking to add transaction banking, cash, payments and other products.

Trade lending has special attractions for today’s commercial bank in Asia in having relatively light capital requirements, quick churning tenors and sticky cross sell upside.

Some, the most advanced with this strategy, are then reaching out to their customer’s Asian trading partners, and seeking to win a slice of their wallets too.

Banks which are taking this path include Wells Fargo and JP Morgan from the US, Deutsche and BNP Paribas from the Euro zone, Australian banks such as ANZ and well-credentialled specialists such as SWIFT, all looking to attack incumbent providers with trade led propositions, be they the large globals, HSBC, Citi and Standard Chartered or the regional players such as DBS and OCBC.

East & Partners’ research shows just how powerful trade finance is in driving profitable cross sell across other banking products.

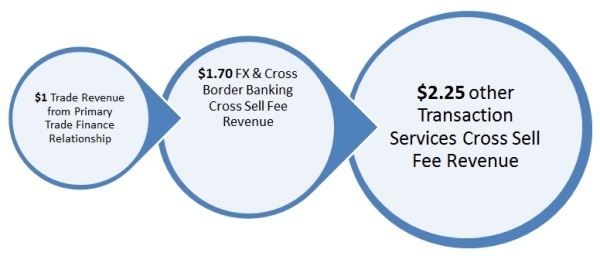

For every $1 of trade finance revenue generated in a primary trade finance relationship, a further $1.70 is generated in foreign exchange and cross border banking fee revenue.

Not only that, but banks which win the role of primary trade finance provider can expect to win as much as $2.25 in other Transactional Services revenue – a total up-sell of four times.

FX, for example, is one of the most commonly banked away products and wallet share is regularly much thinner, but it is a natural follow-on that a trade provider is also a key provider of FX to that same customer.

East’s research shows that customer churn is on the increase in Asia, but we also see that banks which have the primary trade finance relationship can reduce relationship churn on other banking products by an average of 68 percent.

This all points to trade as a key banking relationship. Banks which secure lead trade relationships can build out deeper relationships and win more wallet share across a much wider product spectrum. They can also be more confident that the customers will stay with them.

Already, East’s research is showing how some banks with traction in trade services are appearing, for the first time, as providers of transaction banking services. The interesting dynamic here is a “back to the future” trend with commercial banks returning in force to their origins as facilitators and credit providers to cross border trade flows – the current battle ground for the hears of Asian corporates.

Advertise

Advertise