Japanese megabank edges out global trade financiers in customer satisfaction: survey

Citi, HSBC and Deutsche Bank all trail behind Mitsubishi UFJ.

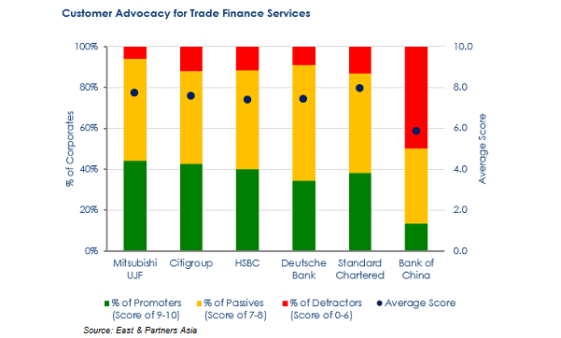

Mitsubishi UFJ has emerged as the top trade finance bank in Asia in terms of customer satisfaction as its corporate customers have expressed more openness to recommend the Japanese megabank to their colleagues and associates, according to a survey from East and Partners that interviewed over 900 CFOs and corporate treasurers across Asia.

Also read: Here are Asia's top trade finance banks

Mitsubishi UFJ achieves the region’s highest advocacy score at 38, which is roughly 2.5 times the industry average. “In short, the Bank has significantly more satisfied customers that are happy to recommend their provider than dissatisfied ones,” the research firm said, citing how the bank is amongst the top five providers in Value for Money and Trade Credit Process categories.

US-based lender Citi comes in at a close second with a rating of 31 followed by HSBC (28), Deutsche Bank (25) and Standard Chartered (25). On the other side of the spectrum, Bank of China has a negative advocacy rating of 37 as customer satisfaction has been on a gradual decline in the past two years.

Also read: Citi targets 25% revenue growth from Asian trade corridors in 2019

“Considering the rising trend of corporates relying on word of mouth and colleague referrals as their main source of trade finance advice, monitoring advocacy metrics will be more important than ever for trade financiers” Sangiita Yoong, East and Partners Analyst said in a report.

In the research, corporates are asked to rate their likelihood of recommending their primary trade finance provider (on a 0-10 scale, with 0= not at all likely to recommend and 10= extremely likely to recommend). The advocacy score is then calculated as the difference between the percentage of Promoters and Detractors.

Advertise

Advertise