Malaysia

TransferWise to launch remittance services in Malaysia

It will also enable customers to access eKYC checks. UK-based fintech firm TransferWise obtained its remittance license in Malaysia which will allow the firm to launch remittances from its fourth Asian location. Previously, TransferWise was only able to enable customers to send money to but not from Malaysia. Apart from this, the license will also allow TransferWise customers in Malaysia to access eKYC (electronic Know Your Customer) checks, instead of having to fulfil KYC requirements face-to-face. “That means customers can open an account by simply submitting documents online, via the TransferWise app or website, without having to travel to a physical branch. This is similar to the experience new Singapore customers currently get,” the firm said in an announcement. TransferWise currently sends money from 43 countries, of which four are in Asia - namely Singapore, Japan and Hong Kong and Malaysia. Meanwhile, it allows money to be sent to 71 countries. “With an online banking penetration rate of over 85% as well as high smartphone adoption, Malaysia is well poised to become an important hub for fintechs in the region,” Malaysian minister of communications and multimedia Gobindh Singh Deo said. Launched in 2011 and headquartered in London, TransferWise handles $5.12b of cross-border transfers every month for its 5 million customers.

TransferWise to launch remittance services in Malaysia

It will also enable customers to access eKYC checks. UK-based fintech firm TransferWise obtained its remittance license in Malaysia which will allow the firm to launch remittances from its fourth Asian location. Previously, TransferWise was only able to enable customers to send money to but not from Malaysia. Apart from this, the license will also allow TransferWise customers in Malaysia to access eKYC (electronic Know Your Customer) checks, instead of having to fulfil KYC requirements face-to-face. “That means customers can open an account by simply submitting documents online, via the TransferWise app or website, without having to travel to a physical branch. This is similar to the experience new Singapore customers currently get,” the firm said in an announcement. TransferWise currently sends money from 43 countries, of which four are in Asia - namely Singapore, Japan and Hong Kong and Malaysia. Meanwhile, it allows money to be sent to 71 countries. “With an online banking penetration rate of over 85% as well as high smartphone adoption, Malaysia is well poised to become an important hub for fintechs in the region,” Malaysian minister of communications and multimedia Gobindh Singh Deo said. Launched in 2011 and headquartered in London, TransferWise handles $5.12b of cross-border transfers every month for its 5 million customers.

Malaysian banks earnings slipped 0.5% in Q1

The sector’s pre-provision operating profit is at its lowest since Q1 2017.

Maybank's Q1 net profit down 3.20% to $430m

Its Singapore unit was hit by a loss before taxation of $19.05m. Maybank’s net profit in Q1 dipped 3.20% YoY to $430m (MYR1.81b) from $450m (MYR1.87b) , an announcement revealed. Meanwhile, revenue inched up 0.7% YoY to $1.40b (MYR5.86b) from $1.39b (MYR5.82b) a year ago. The group saw steady growth in loans across key home markets with the lending portfolio of its Indonesian operations growing by a robust 11.3%., The loans extended by other international markets expanded by 4.7%, Malaysia at 3.7%, and Singapore at 3.4%, bringing the overall group loans growth to 4.8% in Q1. The bank’s Malaysian loan portfolio saw healthy increases in SME loans (12.2%), mortgages (8.6%), auto finance (4.5%), unit trust (6.3%), and credit cards (3.3%). Maybank recorded a 1.6% rise in net operating income to $810m (MYR3.38b) in the region. Net fee based income rose 1.9% to $190m (MYR795m) backed by the growth in wealth management bancassurance fee income. Net fund based income grew 1.5% to $620m (MYR2.58b). For its Islamic banking business, profits before tax skyrocketed 96.9% to $214.32m (MYR896.6m) buoyed by the lower provisioning levels and higher write backs for the quarter as well as the 9.3% rise in total income. Maybank Singapore saw a 3.6% rise in net fund based income to $46.11m (S$192.88m) for Q1, on the back of a 3.4% YoY rise in loans to $10.18m (S$42.6b). However, net fee based income decreased 20.6% YoY to $19.85m (S$83.04m) owing to the absence of a one-off gain made last year. Together with higher loan loss allowances for several existing impaired loans, the bank recorded a loss before taxation of $19.05m (S$79.7m).

Crowdfunding flourishes in Malaysia as banks reject loan applications

Equity crowdfunding and P2P platforms have raised $84m for small businesses so far.

Deutsche Bank launches instant payments for Malaysia corporates

The lender can process payments through DuItNow.

Malaysian banks flex digital muscle to catch up with Asian peers

Employee upskilling is also a priority to ensure that workers can keep up with digital developments.

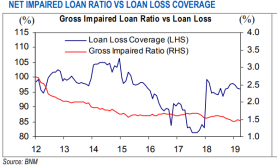

Chart of the Week: Malaysian banks' bad loan ratio down to 1.46% in March

Non-residential property loans were the only segment with deteriorating asset quality.

Malaysian banks hit by lower loan demand

New loan applications shrunk 6% in March.

RHB targets extending $7.5b in SME loans by 2021

The bank has approved $1.74b in SME financing in 2018.

Bain & Company's Gwendolyn Lim shares her framework for redesigning the future's banks

Improved economics, personalised customer experience, and enhanced employee engagement are keys to sustainability.

RHB sets sights on one million mobile banking users by 2019 in mobile app launch

The bank also hopes to boost digital transaction volumes to over 80% by 2022.

Malaysia banks forge ahead with merger plans despite steeper capital rules

Banks can handle the surcharge as CET1 ratios of big lenders range from 12-15.5% in 2018.

RHB unveils multi-currency VISA debit card

It supports 13 currencies including US, Canada, Singapore and Hong Kong dollar.

Malaysian startup Moby Fintech unveils financial decisioning app

Mobylize offers users credit scoring, analysis and decisioning tools.

Malaysia targets web-only bank license rules by end-2019

The central bank had preliminary talks with internet-only bank operators overseas.

Malaysian banks' pre-tax profit hits $9.04b in 2018

Sector earnings grew at a slower pace due to higher MFRS9 provisions.

Alliance Bank Malaysia set to outpace sluggish industry growth

Its loans could grow 6% in FY20 and NIMs could expand 5bp.

Advertise

Advertise