Philippines

Philippine’s bank loans expand by 9.6% YoY in April

It was higher than the previous month’s 9.4%.

Philippine’s bank loans expand by 9.6% YoY in April

It was higher than the previous month’s 9.4%.

Philippines’ Remolona warns of oil prices, interest rates as financial stability risks

The financial stability council also warned of geopolitical risks.

GoTyme Bank launches multi-currency time deposit with $1 minimum

The Philippine-based digital bank promises interest rates between 3% to 3.5%.

Philippine central bank eyes developing local capital markets

It will help make the financial system more resilient, the BSP Governor said.

Wise launches in the Philippines with fee-free money transfer service

Users can receive and spend money internationally and create up to 3 cards.

CTBC Bank PH unveils redesigned web interface and mobile banking app

The app features personalised widgets and customisable features.

PH banks’ total assets expanded 9.2% to $439.3b in 2023

Both lending and investing activity grew during the period.

PH fintech BillEase integrates QRPh in platform with AUB partnership

BillEase customers can now pay at over 600,000 QRPh-accepting merchants.

Philippine loan officer fined for violating lending regulations

The officer was an employee of the now closed Ruran Bank of Buguias (Benguet).

PH banks maintained loan standards in Q1

An estimated 3 in 4 banks maintained credit standards for housing loans.

PH’s BillEase clinched $5m investment from Credit Saison lending arm

BillEase has achieved profitability in 2023 and delivered 47% return on equity.

Zed challenges banking norms with no interest, forward-looking credit card

The soon-to-be-launched card will underwrite based on present and future income, not just past financial records.

PH central bank revokes license of local money changer

Money changer NIKKO reportedly committed “serious violations” of money laundering laws.

Union Bank’s profit outlook dims on higher costs and riskier loans

It has less buffers for loan losses than lower-rated banking peers, Moody’s Ratings warned.

Philippine National Bank’s profitability to improve on more SME loans

Liquidity is expected to decline as it accelerates lending in 2024.

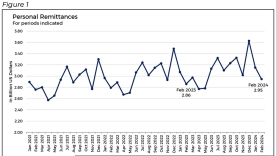

Overseas Filipinos’ remittances up 3% to $2.95b in Feb

A total of $2.65b in remittances coursed through banks, the central bank said.

Personal remittances from Overseas Filipinos (OFs) grew by 3% to $2.95b in February, according to central bank data.

Philippine central bank simplifies FX policy for foreign investment registration

Foreign investments can now be registered upon registering at any authorized agent bank.

Advertise

Advertise